tax on unrealized gains yellen

The new Billionaire Income Tax is being written by Senate Finance Committee Chairman Ron Wyden Democrat. The plan will be included in the Democrats US 2 trillion reconciliation bill.

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen.

. The eyebrows of some senators and Wall Street when she said that the Treasury would consider the possibility of taxing unrealized capital gains through a mark-to-market mechanism as well as other approaches to boost revenues. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government.

An unrealized gain is when something you own gains value but you dont sell it like your house or your retirement fund. That will kill capital formation and dampen investment. Its also true that taxing unrealized capital gains is usually bad tax policy unless you consider the estate tax to be that.

For example they could tax all unrealized capital gains less any unrealized capital losses at a low rate say 1 and then reset the cost-basis to be equal to the marked to market price used to calculate the tax. Government coffers during a virtual conference hosted by The New York Times. If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed.

The Wyden plan by contrast would tax only the unrealized gain a billionaire family had but the long-term capital gains rate is 20 percent. January 26 2021 1013 am. When the income tax first went into effect in 1915 the top rate was a mere 7 and fell only on those making 500000 a year or more.

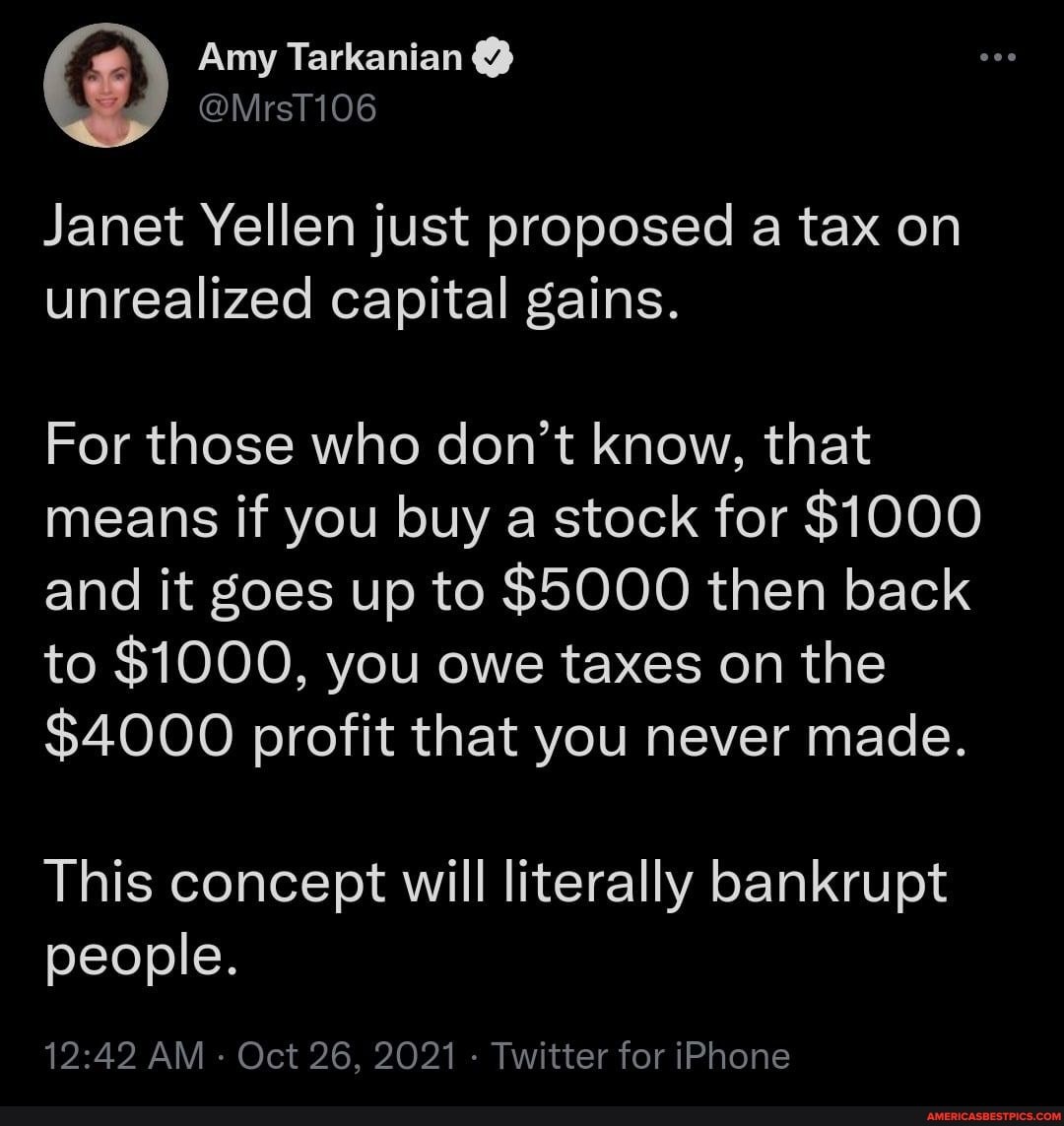

California long term capital gain rate 133. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens now scaled-back 175 trillion social spending bill.

It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in this event and theres still a tax on it. Federal long term capital gain rate 396 BidenYellen proposal v 20 today. They propose to increase the long term capital gains rate to 396.

National Investment Income Tax 38. Ron Wyden D-Oregon would impose an annual. Yellen had first proposed the tax on unrealised capital gains in February 2021.

Total long term capital gain rate 567. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective.

Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

Janet Yellens Preposterous Tax Plan. It is the theoretical profit existent on paper. There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed.

Lawmakers are considering taxing unrealized capital gains. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. For example perhaps you purchased a house at 300000 and sold it for 350000.

A California resident would see the following taxes. Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35. The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US.

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose. Jan 22 2021 - 204am. Reuters January 19 2021.

Yellen said lawmakers are considering a billionaires tax to help pay for Bidens social safety net and climate change bill. Janet Yellen Discusses Unrealized Capital Gains Tax Proposal House Speaker Pelosi Approves. Yellen may say this is about billionaires but lets not forget that when income tax was started in 1913 a family making the.

Meaning that when assets such as stocks crypto and real estate appreciate that value is taxed at the same rate as your income. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans. This proposal suggests that we should be taxing unrealized capital gains as income.

Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. In other words if a transaction occurs in which a tax payer does not have the funds to pay a tax generally wouldnt be owed. That sounds good until you realize that 100000 increase was an unrealized gain.

So when theres inflation and it goes up in value youll. Secretary of the treasury Janet Yellen discussed the subject on CNNs State of the Union Yellen explained the concept. An unrealized capital gains tax would violate this.

Capital gains tax is a tax on the profit that investors realize on the sale. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Janet Yellen Wants To Tax Unrealized Crypto Gains Youtube

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Us Government Unrealized Gains Tax Plans Might Hit Crypto 039 Billionaires 039 Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

What Is Unrealized Gain Or Loss And Is It Taxed

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Billionaire Tax On Unrealized Gains If You Have 1b In Assets Or Earned More Than 100million In 3 Consecutive Years Just Trying To End The Fud I Ve Been Seeing R Superstonk

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only